Most pharmacies carry hundreds of medications, but generic drugs are the real money-makers. They make up 90% of prescriptions filled in the U.S., yet only account for 20% of total drug spending. That’s not a coincidence-it’s a financial opportunity. The problem? Many pharmacies still manage their generic inventory like it’s 2010: guesswork, monthly budgets, and reactive restocking. The result? Stockouts on metformin, expired stock of antacids, and thousands of dollars tied up in slow-moving generics. It doesn’t have to be this way.

Why Generic Stocking Is Different from Brand-Name Inventory

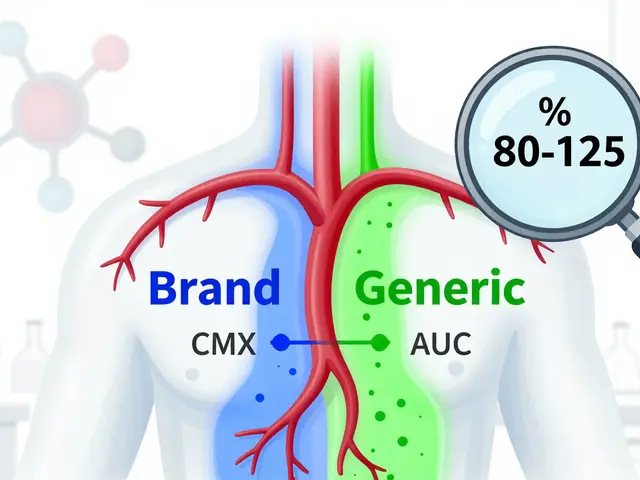

Generic drugs aren’t just cheaper versions of brand-name pills. They’re a different kind of inventory challenge. When a brand-name drug loses its patent, multiple manufacturers rush to produce the same active ingredient. Prices drop fast. Demand shifts overnight. A drug that sold for $300 a bottle can suddenly be $12. That’s great for patients-but it’s chaos for inventory managers. Brand-name drugs have predictable demand. You know how many bottles you’ll sell next month because the prescription volume hasn’t changed in years. Generics? Not so much. One week, you’re ordering 500 bottles of atorvastatin. The next, a new generic hits the market, and your brand-name sales plummet by 70%. If your system doesn’t auto-adjust, you’re left with $15,000 in obsolete stock. The key is treating generics like a live feed, not a static list. You need to track turnover rates, lead times, and expiration dates with surgical precision. And you need software that can do it in real time.The 80/20 Rule in Pharmacy Inventory

Here’s a simple truth: 80% of your drug costs come from just 20% of the medications you carry. For most independent pharmacies, that 20% is made up of high-volume generics-blood pressure meds, diabetes drugs, pain relievers, antibiotics. That means you don’t need to micromanage every single item. Focus on the top 50-70 SKUs that move the fastest. These are your cash cows. Keep them stocked. Track them daily. Let the rest run on autopilot. For example, if you’re running a community pharmacy in Liverpool, you’ll likely see consistent demand for:- Metformin (type 2 diabetes)

- Atorvastatin (cholesterol)

- Levothyroxine (thyroid)

- Amlodipine (blood pressure)

- Alendronate (osteoporosis)

- Lansoprazole (acid reflux)

- Amoxicillin (antibiotic)

How to Set Your Reorder Points (ROP) and Reorder Quantities (ROQ)

Forget monthly orders. The modern pharmacy uses formulas to calculate exactly when and how much to order. Reorder Point (ROP) tells you when to trigger a new order. Use this formula:ROP = (Average Daily Usage × Lead Time in Days) + Safety Stock

Let’s say you sell 10 bottles of metformin per day. Your supplier takes 3 days to deliver. You want a 2-day safety buffer. Your ROP is:(10 × 3) + 20 = 50 bottles

When your stock hits 50, your system should auto-generate an order. Reorder Quantity (ROQ) tells you how many to order. The Economic Order Quantity (EOQ) model helps balance ordering costs and holding costs. For most generics, ordering in bulk makes sense-but only if they don’t expire. That’s why you need to factor in shelf life. For fast-movers like metformin or lisinopril, order enough to last 30-45 days. For slower ones, like rare thyroid formulations, order just enough to cover 14 days. Too much? You risk expiration. Too little? You lose sales.Minimum/Maximum Inventory: The Simplest System That Works

Not every pharmacy has fancy AI tools. But every pharmacy can use the minimum/maximum method. Set two numbers for each generic:- Minimum: The lowest stock level before you reorder. For metformin, that’s 50 bottles.

- Maximum: The most you want on hand. For metformin, that’s 150 bottles.

Track Expiry Dates Like Your Profit Depends on It

Here’s the dirty secret: generics often have shorter shelf lives than brand-name drugs. Why? Because manufacturers cut costs. They use cheaper packaging. They skip stability testing. The result? A 24-month shelf life instead of 36. If you’re not tracking expiry dates by lot number, you’re gambling. One pharmacy in Manchester lost $8,000 last year because they didn’t spot a batch of omeprazole that expired in 18 months instead of 24. Your system must:- Flag items expiring in 60 days

- Push those to the front of the shelf

- Alert you if a drug is nearing expiration and hasn’t moved

- Allow you to return expired stock to suppliers (many will take it back if it’s unopened)

How New Generics Change Everything

Every month, 15-20 new generics hit the market. Each one disrupts your inventory. When a new generic for atorvastatin launches, your brand-name sales don’t just drop-they collapse. Within 60 days, 80% of prescriptions switch. If you keep ordering the brand-name version, you’re wasting money. The fix? Have a protocol.- Monitor FDA and PBA Health alerts for new generic approvals

- When a new generic is approved, reduce your brand-name order by 50% in the next cycle

- Order 2-3 weeks’ worth of the new generic to test demand

- If sales hit 10+ units per week, increase order size to 4-6 weeks’ supply

What Happens When You Get It Wrong

Bad generic inventory doesn’t just cost money-it costs trust. One pharmacy in Liverpool had eight stockouts of metformin in three months. Patients called. Patients complained. Patients switched pharmacies. Lost sales? $1,200. Lost reputation? Priceless. Another pharmacy kept ordering brand-name lisinopril after a generic hit. They ended up with $3,200 in expired stock. Their supplier wouldn’t take it back. They had to throw it away. The opposite is also true. A pharmacy in Birmingham implemented automated refill synchronization for maintenance generics. Their inventory carrying costs dropped 18%. Fill rates went up 12%. Their patients noticed. They started referring friends.

Staff Training and SOPs: The Hidden Key

No software fixes bad habits. Your staff must know how to:- Enter received generics correctly (lot number, expiry, cost)

- Return unclaimed prescriptions to stock within 24 hours

- Flag slow-moving items during daily checks

- Use therapeutic interchange protocols when a brand-name is out of stock

Technology That Makes It Easy

You don’t need a $50,000 system. But you do need software that does three things:- Tracks ROP and ROQ for each generic

- Alerts you to expiring stock

- Adjusts orders automatically when new generics enter the market

Final Rule: Keep It Lean, Keep It Smart

The goal isn’t to have the most stock. It’s to have the right stock-when it’s needed, at the lowest cost. Start small. Pick five high-volume generics. Set their min/max levels. Track their turnover. Watch their expiry dates. Adjust your orders weekly. Once that’s working, add five more. Then ten. Slowly, your inventory will become lean, responsive, and profitable. Generic drugs are the backbone of modern pharmacy. Managing them well isn’t optional-it’s survival. The pharmacies that thrive in the next five years won’t be the ones with the biggest shelves. They’ll be the ones with the smartest systems.How often should I check generic inventory levels?

Check high-turnover generics daily-especially metformin, atorvastatin, and amlodipine. Use automated alerts to flag when stock hits your minimum level. For slower-moving generics, a weekly review is sufficient. Always run an expiry report every Monday to catch items that need to be moved or returned.

What’s the ideal percentage of generics in my inventory?

For independent pharmacies, aim for 65-75% of your total inventory value to be generics. That’s the sweet spot where you maximize cost savings without overstocking. In terms of prescriptions, 90% of what you dispense should be generic-that’s industry standard. Your inventory should reflect that ratio.

How do I handle a new generic entering the market?

When a new generic launches, immediately reduce your order of the brand-name version by 50-75%. Order a small trial batch of the new generic (2-3 weeks’ supply). Monitor sales over the next 30 days. If demand hits 10+ units per week, increase your order to a 4-6 week supply. Use software alerts to track these transitions automatically.

Can I return expired generics to suppliers?

Yes, many wholesalers will accept returns of unopened, non-expired generics-especially if they’re in good condition and you have documentation. Always check your supplier’s return policy. Some require a return authorization number. Others offer credit only if the item expires within 60 days of delivery. Keep detailed records of all returns.

What’s the biggest mistake pharmacists make with generic inventory?

The biggest mistake is treating all generics the same. Some move fast. Some move slow. Some expire quickly. Some are stable for years. Using one rule for all leads to overstock on slow-movers and stockouts on fast-movers. The solution? Segment your generics by turnover rate, shelf life, and demand predictability-and manage each group differently.

13 Comments

This is the kind of practical advice every pharmacy needs to hear. I’ve seen too many shops drown in expired stock while patients walk out because metformin’s gone. Simple systems like min/max levels? Genius. No fancy AI needed-just discipline.

Ugh. You people are still using MIN/MAX?? Come on. If you’re not using AI-driven demand forecasting by 2025, you’re literally throwing money away. I’ve seen pharmacies lose $20K in a quarter because they didn’t auto-adjust for new generics. Stop guessing. Start algorithming.

📊 Data point: A 2024 JAMA study showed pharmacies using real-time inventory tracking reduced generic stockouts by 68% and expired inventory by 54%. This isn’t opinion-it’s evidence-based pharmacy management. The ROI on even a $500/month software upgrade is 7x within 6 months. Stop debating. Start implementing.

YES. This. I run a small shop in Ohio and we switched to min/max for our top 10 generics six months ago. We used to have weekly panic calls about metformin. Now? We get alerts. We restock on autopilot. Staff actually have time to talk to patients instead of chasing inventory ghosts. This isn’t just smart-it’s liberating.

But what about the patients who can’t afford even the generic?? You’re so focused on profit you forget why we’re here. I’ve seen people cry because they couldn’t get their thyroid med because the pharmacy ‘ran out’-and they didn’t even offer a discount on the expired ones! This feels cold.

I work in a pharmacy in Atlanta with a huge immigrant population. We’ve started bundling high-turnover generics with free health pamphlets in Spanish and Bengali. It’s not just about inventory-it’s about trust. When people know you’re keeping their meds reliable, they stick with you. Even if they’re on a fixed income. This system works because it’s human-centered, not just math-centered.

Effective inventory management requires consistency. Daily review of high-volume generics is non-negotiable. Weekly expiry reports are essential. Automated alerts reduce human error. Implementation should be phased. Begin with five medications. Master the process. Then expand. Discipline yields results.

man i just read this whole thing and i’m like… why is this even a problem? like… we’ve had barcode scanners since the 90s. why are we still talking about min/max like it’s a breakthrough? also i just typoed ‘generic’ as ‘genric’ 3 times and now i feel judged

As someone running a pharmacy in Manchester, I can confirm: the expiry issue is real. We lost £5k last year on omeprazole because the batch label said 36 months but the manufacturer’s data sheet said 24. We didn’t cross-check. Don’t assume. Verify. Always. And yes, suppliers will take returns-if you document it properly.

Let me tell you something that no one’s saying out loud: the real bottleneck isn’t the software-it’s the staff. I’ve seen pharmacies buy the fanciest system on the market, then have the techs enter lot numbers wrong, or ignore expiry alerts because ‘it’s just one bottle’. Culture eats strategy for breakfast. You need to train your team to treat inventory like it’s their own money. Not because it’s policy-but because they care. Start with incentives. Tie a small bonus to reducing expired stock. Watch the mindset shift. It’s not about tech. It’s about ownership.

The philosophical underpinning of this approach reveals a fundamental tension in healthcare economics: efficiency versus equity. When we optimize for cost reduction through algorithmic inventory control, we implicitly prioritize capital preservation over patient accessibility. The paradox lies in the fact that generics were designed to democratize medicine, yet their management has become a corporate calculus. One must ask: are we managing drugs-or managing profit margins disguised as stewardship?

Bro, in India we’ve been doing this since the 2000s-only we call it ‘jugaad’ inventory. You know what that means? Making it work with whatever you got. We track expiry dates with sticky notes on the shelf, use WhatsApp groups to alert each other when a new generic drops, and barter expired stock with local clinics for free lab tests. No fancy software. Just hustle. Your system works, but real genius is making it work with no budget. Keep it simple. Stay sharp.

Umm hello? This whole post is just corporate fluff. Who even cares about profit margins? The real problem is pharmacies are owned by big chains that don’t care about patients. They just want to squeeze every dime. You think a min/max system fixes that? Nah. It just makes the exploitation more efficient. Wake up.