When you hear the word biosimilar, you might think it’s just another cheap version of a brand-name drug-like a generic pill. But biosimilars aren’t generics. They’re not even close. Generics copy small-molecule drugs made with chemicals. Biosimilars copy complex biologic drugs made from living cells-like proteins, antibodies, or vaccines. These aren’t just pills you swallow. They’re injections, infusions, treatments for cancer, rheumatoid arthritis, diabetes, and more. And the difference between how Europe and the United States handle them is shaping the future of global healthcare costs.

Europe Got There First-And It Shows

Europe didn’t just jump into biosimilars. It built a system. In 2006, the European Medicines Agency (EMA) approved the world’s first biosimilar: Omnitrope, a version of the growth hormone somatropin. That wasn’t a trial run. It was the start of a decade-long rollout. By 2024, Europe’s biosimilar market hit $13.16 billion in revenue, according to Precedence Research. Germany, France, and the UK led the charge, with hospitals using centralized tenders to push biosimilars into use. In some countries, doctors automatically get biosimilars unless they write a specific reason not to. That’s called mandatory substitution-and it’s standard in places like Germany. The EMA didn’t require endless clinical trials. Instead, they used a “totality-of-evidence” approach. That means: show the molecule is nearly identical in structure, run lab tests, compare how it behaves in the body, and do a few targeted studies in one patient group. If the data lines up, the drug gets approved. No need to test it in every disease it’s used for. That kept costs down and sped things up. By 2025, over 100 biosimilars had been approved in Europe. Many of them are used in oncology and autoimmune diseases-where biologics cost $100,000 a year or more. In places like Sweden and the Netherlands, biosimilars now make up over 80% of the market for drugs like infliximab and rituximab.The U.S. Started Late-And Got Stuck

The U.S. didn’t even have a legal path for biosimilars until 2009, when Congress passed the Biologics Price Competition and Innovation Act (BPCIA). But passing a law and making it work are two different things. The first U.S. biosimilar, Zarxio (a version of filgrastim), didn’t hit shelves until 2015. Why the delay? Patent thickets. Big pharma companies piled on dozens of patents around their biologics-some covering delivery devices, storage methods, even manufacturing steps. That created legal traps. Companies wanting to launch biosimilars had to go through a “patent dance”-a confusing, costly legal back-and-forth that often ended in lawsuits. Many biosimilars were blocked for years. Then there was the interchangeability problem. The FDA required biosimilars to prove they could be switched back and forth with the original drug without any risk. That meant running expensive, time-consuming clinical studies where patients were repeatedly switched between the biosimilar and the original. Most companies couldn’t justify the cost. By 2024, only 12 biosimilars had launched in the U.S., compared to over 100 in Europe. Even when approved, many sat on shelves because insurers and pharmacies didn’t want to switch patients.The Turning Point: FDA Changes in 2024

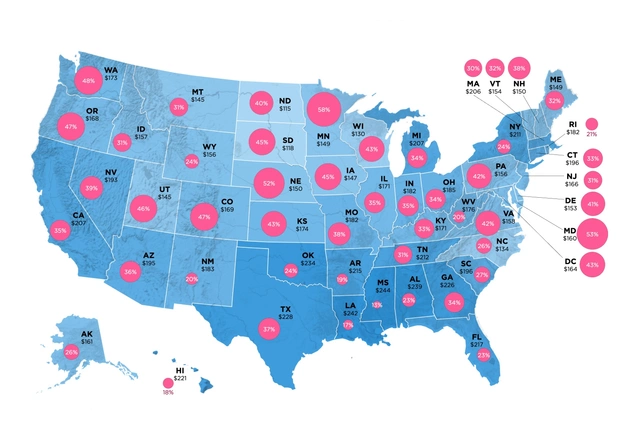

Everything started shifting in June 2024. The FDA proposed new rules eliminating the requirement for switching studies to get interchangeable status. That was a game-changer. Suddenly, biosimilar makers didn’t need to spend millions proving patients could be safely switched. They just needed to show the drug was highly similar-and that’s what the EMA had been doing for years. The U.S. was finally catching up to Europe’s model. The Inflation Reduction Act of 2022 helped too. It closed the Medicare Part D “donut hole,” meaning seniors no longer faced sky-high out-of-pocket costs after hitting a spending cap. That made biosimilars more attractive to payers. Hospitals and insurers saw real savings. For example, when Humira (adalimumab) lost patent protection in 2023, 14 biosimilars were approved in the U.S. Six were available right away. By 2025, that number had jumped to 10. Prices dropped 40% in some states within months.

Market Size: Europe Still Leads, But the U.S. Is Catching Fast

As of 2024, Europe’s biosimilar market was worth about $13.16 billion. The U.S. market was $10.9 billion, according to Alira Health. But growth rates tell a different story. The U.S. market is projected to grow at 18.5% annually through 2033, according to IMARC Group. Europe’s growth is slower-around 17.3%-because it’s already more mature. The U.S. is catching up fast. By 2027, North America (mostly the U.S.) is expected to overtake Europe as the largest biosimilar market in the world, with Grand View Research predicting $17.2 billion in revenue. Why? Because the U.S. has more high-value biologics coming off patent. Between 2025 and 2034, 118 biologics will lose exclusivity. That’s a $232 billion opportunity, according to IQVIA. Drugs like Enbrel, Remicade, and Herceptin are next in line. Each one could save the U.S. healthcare system billions if biosimilars take hold.Who’s Making Them? Who’s Buying?

In Europe, the big players are Sandoz (Novartis), Fresenius Kabi, and Amgen. They’ve spent years building manufacturing capacity in Germany, where biosimilar production is now a strategic industry. German labs produce biosimilars not just for Europe, but for global export. In the U.S., Pfizer, Merck, and Samsung Bioepis are leading the charge. Pfizer’s Adalimumab biosimilar (Amlan) is already cutting costs in Medicaid programs. Merck’s version of Bevacizumab is being used in cancer centers across the Midwest. The U.S. market is more fragmented-private insurers, Medicare, VA hospitals all make their own decisions. But now that interchangeability rules are relaxed, big pharmacy chains like CVS and Walgreens are starting to push biosimilars as default options.Therapeutic Areas: Where the Action Is

In Europe, biosimilars took off fastest in autoimmune diseases-rheumatoid arthritis, Crohn’s disease, psoriasis. These are chronic conditions requiring lifelong treatment. A $100,000 drug becomes $60,000 with a biosimilar. That’s life-changing for patients and payers. In the U.S., adoption started with supportive care drugs like filgrastim (used after chemotherapy to boost white blood cells). It’s simpler to switch. Now, the focus is shifting to oncology and immunology. In 2024, biosimilars for trastuzumab (used in breast cancer) and rituximab (used in lymphoma) began rolling out. Early data shows they work just as well. No new side effects. No drop in survival rates. That’s the key: no clinically meaningful difference.

Why This Matters Beyond the Numbers

Biosimilars aren’t just about saving money. They’re about access. In the U.S., many patients skip biologic treatments because they cost too much. In Europe, biosimilars made these drugs affordable for millions. A 2024 study in the Journal of Managed Care & Specialty Pharmacy found that after biosimilars entered the German market for infliximab, the number of patients receiving treatment increased by 22% in two years. That’s not just cost savings-it’s better health outcomes. The U.S. is starting to see the same effect. In states where Medicaid expanded biosimilar use, hospital admissions for flare-ups of autoimmune diseases dropped by 15%. That’s fewer ER visits. Fewer hospital stays. Lower overall costs.The Road Ahead: Convergence, Not Competition

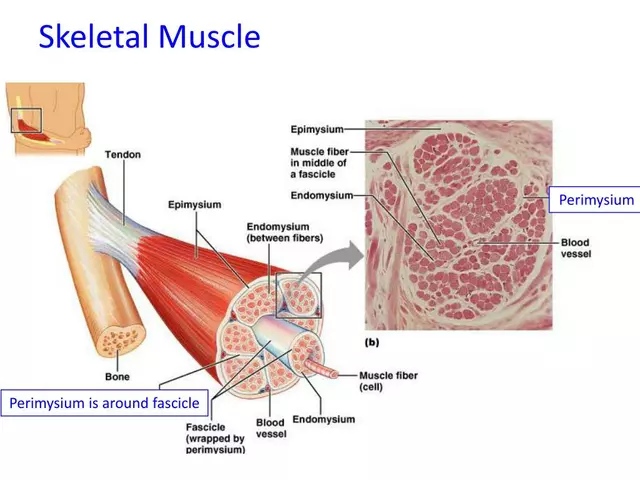

The gap between Europe and the U.S. is narrowing. The FDA’s 2024 rule change was the biggest signal yet: the U.S. is adopting Europe’s science-based, efficient approach. Both regions now accept similar analytical data, non-clinical studies, and limited clinical trials to prove biosimilarity. The difference now is speed, not science. Manufacturing is still a challenge. Biologics are made in living cells-yeast, bacteria, mammalian cells. Even tiny changes in temperature, pH, or nutrient mix can alter the final product. That’s why biosimilars are harder to make than generics. But companies are getting better. New facilities in the U.S. and Eastern Europe are scaling up production. The real hurdle now is education. Many doctors still think biosimilars are “inferior.” Patients worry they’re less safe. That’s changing. Real-world data from Europe has shown no difference in safety or effectiveness over 10+ years. The FDA is now funding public awareness campaigns. Medical schools are adding biosimilar training to curricula.What’s Next?

By 2030, biosimilars could save the U.S. healthcare system over $100 billion, according to the Congressional Budget Office. Europe will save even more. The global market is projected to hit $175 billion by 2034. That’s not a small number. It’s a revolution. The lesson from Europe? Clear rules, early adoption, and trust in science work. The U.S. is learning it the hard way. But now that the barriers are falling, biosimilars won’t just be a cost-saving tool. They’ll become the standard of care.Are biosimilars the same as generics?

No. Generics are exact copies of small-molecule drugs made from chemicals. Biosimilars are highly similar versions of complex biologic drugs made from living cells. They’re not identical-no two biologics are-but they have no clinically meaningful differences in safety, purity, or effectiveness. You can’t make a biosimilar the same way you make a generic pill.

Why are biosimilars cheaper than the original biologics?

Because they don’t need to repeat all the expensive early-stage research. The original biologic company spent billions developing the drug and proving it works. Biosimilar makers only need to prove their version is highly similar using analytical tests and targeted clinical studies. That cuts development costs by 70-80%. They also enter markets with existing demand, so they don’t need to spend as much on marketing.

Can a pharmacist switch my biologic to a biosimilar without asking me?

In Europe, yes-in many countries, pharmacists can substitute biosimilars automatically unless the doctor says no. In the U.S., it depends. Only biosimilars with “interchangeable” status can be switched without the prescriber’s permission. As of 2025, only a handful of U.S. biosimilars have that status, but more are expected after the FDA’s 2024 rule change. Always check with your pharmacist or doctor if you’re unsure.

Are biosimilars safe?

Yes. Over 100 biosimilars have been used in Europe for nearly 20 years. Millions of patients have received them. Studies show no increase in side effects, no loss of effectiveness, and no higher risk of immune reactions compared to the original biologic. The FDA and EMA require the same strict standards for safety and quality. If a biosimilar is approved, it’s safe.

Why did the U.S. take so long to adopt biosimilars?

Three main reasons: patent lawsuits delayed launches, the FDA required expensive switching studies for interchangeable status, and the healthcare system is fragmented. Insurers, pharmacies, and doctors didn’t coordinate on adoption. Plus, originator companies spent millions to discourage substitution. All that changed after 2022 with the Inflation Reduction Act and the FDA’s 2024 rule change removing the switching study requirement.

Which region will lead the biosimilar market in the future?

Europe still leads in total market size today, but the U.S. is growing faster. By 2027, North America is projected to surpass Europe in revenue, thanks to the wave of high-value biologics coming off patent. The U.S. has a bigger market to fill-$232 billion in potential savings over the next decade. Europe’s growth will continue, but the U.S. is catching up quickly.

11 Comments

Man, I never realized biosimilars were this complex. Back home in India, we just call them 'cheap copies' and move on. But this breakdown? Eye-opening. Europe’s system actually makes sense-no need to reinvent the wheel every time.

Oh wow, so Europe’s been doing this since 2006 and we’re only now catching up because Big Pharma got scared? Classic. The FDA didn’t delay biosimilars because of science-they delayed them because lawyers got richer. And now they’re acting like they had a genius idea all along. 🤡

This is actually really hopeful. I’ve seen patients struggle to afford their biologics-some skip doses, some just give up. If biosimilars can bring down costs without sacrificing safety, that’s not just smart policy, it’s moral. Glad the FDA’s finally listening.

As someone who works in hospital administration, I can tell you: the shift is real. Last quarter, we switched 70% of our infliximab prescriptions to biosimilars. Patient outcomes? Identical. Costs? Down 45%. The real win? Nurses have more time to care, not chase paperwork. This isn’t just economics-it’s better medicine.

Europe is just letting foreign drugs in because they dont care about American jobs. The FDA used to protect us. Now they're just bowing to globalist pharma giants. And don't even get me started on how they're forcing this on seniors. You think this is about savings? Nah. It's about control.

So what? Biosimilars are just generics with extra steps. Why do we even need this whole system? Doctors should just prescribe what's cheapest and shut up. I don't care if it's made in Germany or a lab in Bangalore. If it works, give it to me. Stop overcomplicating everything

Europe's system is a disaster waiting to happen. They approve drugs based on 'totality of evidence'? That's not science, that's wishful thinking. You can't replicate living cells perfectly. One wrong protein fold and you get autoimmune chaos. The FDA was right to be cautious. Now they're just copying Europe because they're too lazy to innovate.

OMG I just learned so much!! 🤯 Biosimilars are like the Avengers of affordable meds-same power, less cost!! 💪💉 I’m telling my rheumatologist tomorrow!! #BiosimilarRevolution #HealthcareForAll

Look, I get the frustration with patent thickets. But the FDA’s old rules weren’t about protecting Big Pharma-they were about protecting patients from unpredictable outcomes. Europe’s track record is good, sure. But the U.S. has a bigger, more diverse population. We can’t just copy-paste. The new rules are a step forward, but we still need guardrails.

Let’s be real-Australia’s doing better than both. We had biosimilars in 2012. No lawsuits, no drama. Pharmacists swap them automatically. Patients get cheaper meds. Hospitals save cash. And nobody died. The U.S. is still stuck in 2009 while the rest of the world moves on.

So the FDA changed the rules because they got pressured? That’s not science, that’s politics. And now they’re pretending this was their idea all along? The whole biosimilar system is a Trojan horse for global drug price controls. You think this is about access? It’s about breaking American innovation. Mark my words-this will backfire.