Pricing: How to Cut Medication Costs Without Sacrificing Safety

Drug prices can surprise you. One pharmacy quote can be $50, another $5 for the same pill. If you care about price, knowing a few quick checks will save money and time without risking your health.

First, compare real prices fast. Use price apps and comparison sites to see cash prices, not just insurance estimates. Apps like GoodRx alternatives show coupons, pharmacy reach, and real discounts. Check multiple pharmacies in your area and include online Canadian or international pharmacies if you live where that’s legal. Count shipping and handling into the final price.

Where big savings hide

Generics usually cost far less than brand drugs but work the same when approved. Ask your doctor or pharmacist about generic options or therapeutic alternatives. Pharmacy savings cards, discount apps, and manufacturer coupons can cut costs further. For chronic meds, look for 90-day supplies or mail-order options — the per-pill price often drops. Also hunt for patient assistance programs and non-profit resources if you have low income or no insurance.

Watch for red flags when price looks too good. Extremely cheap pharmacies might skip prescriptions, sell counterfeit products, or have poor shipping practices. Verify any online pharmacy by checking pharmacy reviews, SSL secure checkout, and whether they require a valid prescription. Reviews like our site’s pharmacy guides can point out trusted options and risky sites.

Practical pricing tips that actually work

Bring a paper or digital price list to your doctor visit and ask if a cheaper option exists. If a prescribed drug is expensive, ask about an equivalent that costs less. For single-use or short-course drugs, compare local retail prices because shipping makes small orders expensive. For ongoing meds, use automatic refill programs with good pharmacies to lock in steady pricing and avoid surprises.

If you buy online, pick pharmacies with clear contact info, proper licensing, and pharmacist access. Avoid sites that push bulk orders without prescriptions. When a site claims "pharmacy savings" but demands odd payment methods, walk away. Use credit cards or trusted payment services for buyer protection, and keep records of orders and receipts in case you need refunds or dispute charges.

Price matters, but safety matters more. Balancing the two means using verified pharmacies, comparing real costs, and leaning on coupons or assistance programs. A small effort up front — five minutes of checking prices and credentials — often saves money and avoids headache later.

One quick example: a 30-day supply of a cholesterol pill can run $120 at one chain and $18 with a coupon at another. Call both pharmacies before you order. If you use insurance, compare copay vs cash price — sometimes paying cash with a coupon is cheaper. Also check manufacturer copay cards if you qualify; they can cut brand-name costs dramatically. Keep a simple spreadsheet or note app with prices for your regular meds. When prices change, update it. Small tracking saves big over a year.

Ask pharmacists for coupons and cheaper fill options.

The cost of cefixime: understanding pricing and insurance coverage

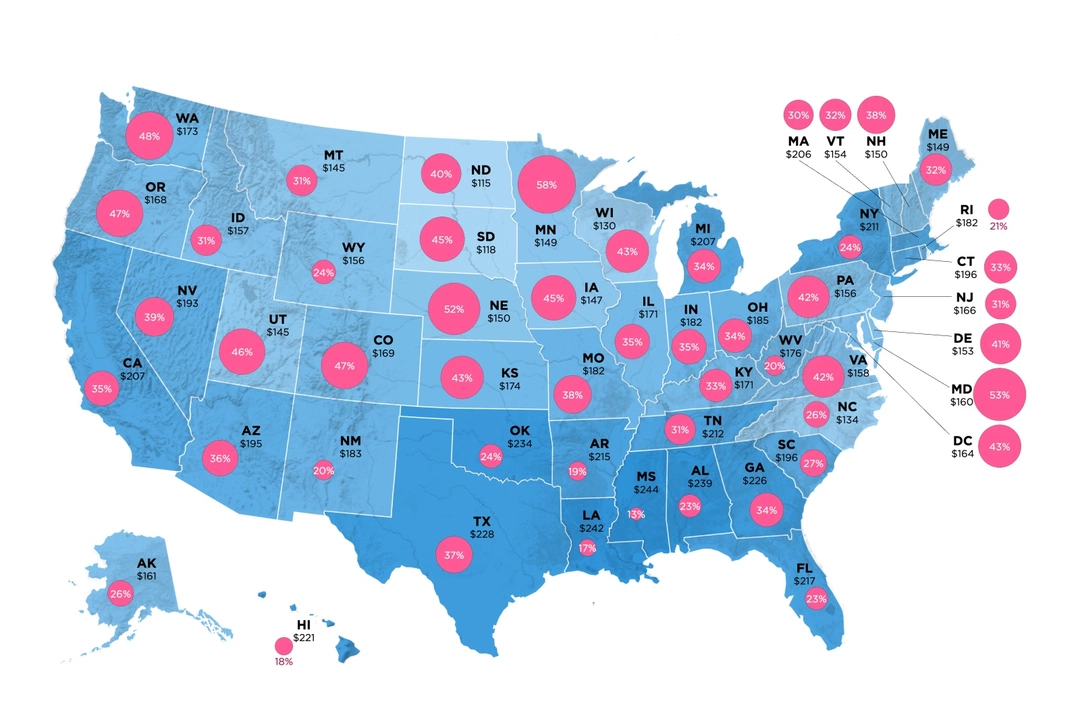

As a blogger, I recently explored the cost of cefixime, a commonly prescribed antibiotic. I discovered that pricing can vary significantly depending on factors such as location, pharmacies, and manufacturer. Additionally, I found that insurance coverage plays a crucial role in the affordability of this medication. For those without insurance or with high deductibles, the cost of cefixime can be a burden. It's essential for patients to research and compare prices to find the best deal, and consider generic options for more affordable alternatives.

Keep Reading