Insurance coverage: what it really means for your prescriptions

Your insurance may say it covers a medicine, but the price you pay can still surprise you. Coverage rules—formularies, tiers, prior authorizations, and mail-order clauses—decide whether a drug is cheap, expensive, or blocked. This page collects articles and real tips so you can lower out‑of‑pocket costs and avoid common traps when buying meds online or in person.

Quick ways to cut prescription costs

First, check your plan’s formulary. That list tells you which drugs are preferred and which land in higher-cost tiers. Ask your prescriber to pick a formulary option or a generic equivalent. Generics often cost far less and work the same for most conditions.

Use coupon and savings apps before you buy. Our roundup of apps like GoodRx (see "Top 7 Budget‑Friendly Prescription Savings Apps Like GoodRx") shows how coupons can beat your co-pay on many everyday meds. Also try manufacturer copay cards and patient assistance programs for brand drugs—these help when insurance doesn't cover the full cost.

Buying online and insurance: what to watch for

If you order from online pharmacies, confirm they accept your insurance or offer transparent cash prices. Some sites on this site (for example, Canadawidepharmacy.com and topmednorx.com reviews) may offer lower cash prices but won’t bill your insurer. That can be fine if the cash price is better than your co‑pay—compare before you click.

Be careful with overseas sellers. Lower price can mean lower quality or legal risk. Read guides like "How and Where to Safely Buy Tretinoin Online" or "Buy Neurontin Online Safely" to learn safe ordering steps: verify pharmacy credentials, require a prescription, and check customer reviews. Never skip the prescription—if a pharmacy sells controlled meds without one, that’s a red flag.

Practical checklist before you fill a prescription:

- Confirm formulary status and tier with your insurer.

- Ask your doctor about a generic or therapeutic alternative.

- Compare your insurance co-pay vs. cash price on trusted online pharmacies.

- Use coupon apps and manufacturer programs when available.

- Make sure the pharmacy is licensed and requires a prescription.

Specialty drugs and chronic meds need extra attention. They may require prior authorization or step therapy, which delays starts and affects cost. Call your insurer and the prescribing clinic—sometimes a short appeal or a different code gets approval faster.

Finally, document everything. Keep receipts, prior authorization numbers, and emails. If a claim is denied or a price is wrong, a clear record makes disputes far easier to win. Use the related articles on this tag to dig deeper into saving strategies, safe online pharmacies, and drug‑specific coverage tips.

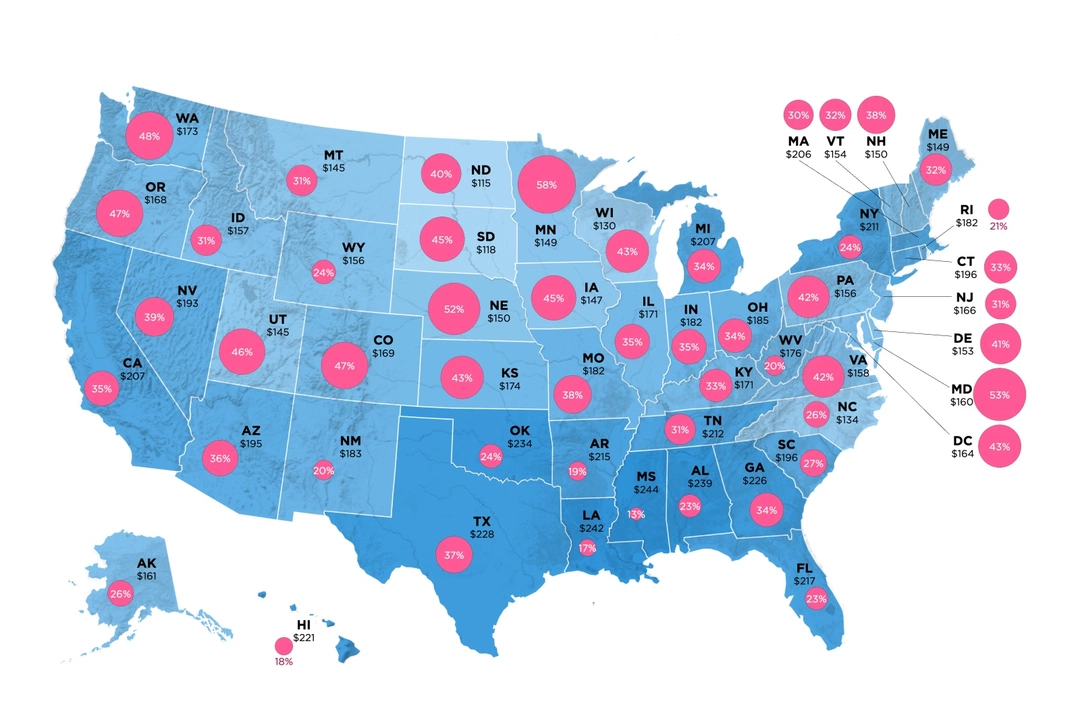

The cost of cefixime: understanding pricing and insurance coverage

As a blogger, I recently explored the cost of cefixime, a commonly prescribed antibiotic. I discovered that pricing can vary significantly depending on factors such as location, pharmacies, and manufacturer. Additionally, I found that insurance coverage plays a crucial role in the affordability of this medication. For those without insurance or with high deductibles, the cost of cefixime can be a burden. It's essential for patients to research and compare prices to find the best deal, and consider generic options for more affordable alternatives.

Keep Reading